By Katz, Sapper & Miller’s Veterinary Services Group

This article originally appeared on ksmcpa.com

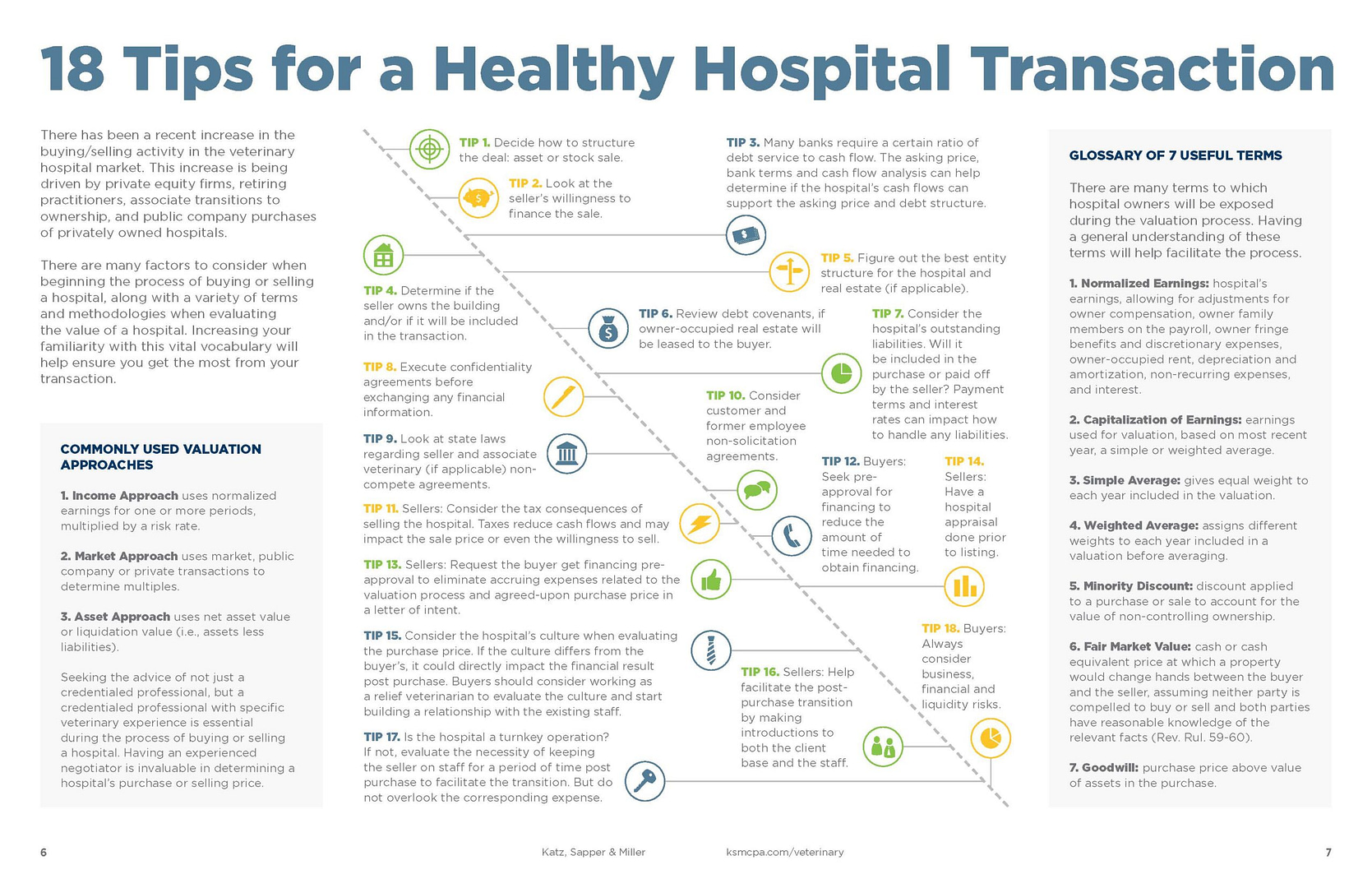

There has been a recent increase in the buying/selling activity in the veterinary hospital market. This increase is being driven by private equity firms, retiring practitioners, associate transitions to ownership, and public company purchases of privately owned hospitals.

There are many factors to consider when beginning the process of buying or selling a hospital, along with a variety of terms and methodologies when evaluating the value of a hospital. Increasing your familiarity with this vital vocabulary will help ensure you get the most from your transaction.

TIP 1. Decide how to structure the deal: asset or stock sale.

TIP 2. Look at the seller’s willingness to finance the sale.

TIP 3. Many banks require a certain ratio of debt service to cash flow. The asking price, bank terms and cash flow analysis can help determine if the hospital’s cash flows can support the asking price and debt structure.

TIP 4. Determine if the seller owns the building and/or if it will be included in the transaction.

TIP 5. Figure out the best entity structure for the hospital and real estate (if applicable).

TIP 6. Review debt covenants, if owner-occupied real estate will be leased to the buyer.

TIP 7. Consider the hospital’s outstanding liabilities. Will it be included in the purchase or paid off by the seller? Payment terms and interest rates can impact how to handle any liabilities.

TIP 8. Execute confidentiality agreements before exchanging any financial information.

TIP 9. Look at state laws regarding seller and associate veterinary (if applicable) non-compete agreements.

TIP 10. Consider customer and former employee non-solicitation agreements.

TIP 11. Sellers: Consider the tax consequences of selling the hospital. Taxes reduce cash flows and may impact the sale price or even the willingness to sell.

TIP 12. Buyers: Seek pre-approval for financing to reduce the amount of time needed to obtain financing.

TIP 13. Sellers: Request the buyer get financing pre-approval to eliminate accruing expenses related to the valuation process and agreed-upon purchase price in a letter of intent.

TIP 14. Sellers: Have a hospital appraisal done prior to listing.

TIP 15. Consider the hospital’s culture when evaluating the purchase price. If the culture differs from the buyer’s, it could directly impact the financial result post purchase. Buyers should consider working as a relief veterinarian to evaluate the culture and start building a relationship with the existing staff.

TIP 16. Sellers: Help facilitate the post-purchase transition by making introductions to both the client base and the staff.

TIP 17. Is the hospital a turnkey operation? If not, evaluate the necessity of keeping the seller on staff for a period of time post purchase to facilitate the transition. But do not overlook the corresponding expense.

TIP 18. Buyers: Always consider business, financial and liquidity risks.

COMMONLY USED VALUATION APPROACHES

1. Income Approach uses normalized earnings for one or more periods, multiplied by a risk rate.

2. Market Approach uses market, public company or private transactions to determine multiples.

3. Asset Approach uses net asset value or liquidation value (i.e., assets less liabilities).

Seeking the advice of not just a credentialed professional, but a credentialed professional with specific veterinary experience is essential during the process of buying or selling a hospital. Having an experienced negotiator is invaluable in determining a hospital’s purchase or selling price.

GLOSSARY OF 7 USEFUL TERMS

There are many terms to which hospital owners will be exposed during the valuation process. Having a general understanding of these terms will help facilitate the process.

1. Normalized Earnings: hospital’s earnings, allowing for adjustments for owner compensation, owner family members on the payroll, owner fringe benefits and discretionary expenses, owner-occupied rent, depreciation and amortization, non-recurring expenses, and interest.

2. Capitalization of Earnings: earnings used for valuation, based on most recent year, a simple or weighted average.

3. Simple Average: gives equal weight to each year included in the valuation.

4. Weighted Average: assigns different weights to each year included in a valuation before averaging.

5. Minority Discount: discount applied to a purchase or sale to account for the value of non-controlling ownership.

6. Fair Market Value: cash or cash equivalent price at which a property would change hands between the buyer and the seller, assuming neither party is compelled to buy or sell and both parties have reasonable knowledge of the relevant facts (Rev. Rul. 59-60).

7. Goodwill: purchase price above value of assets in the purchase.